The pre-approval stage can be a needed action prior to deciding to can secure a mortgage. This really is why homeowners purchasing for different lenders get pre-accepted for numerous loans before settling down on the right one particular for them.

With Money Direct Flexi Line™ you can take what you require any time you have to have it, and pay out it down when it works for yourself. Fork out again at your own rate minimum amount payment requirements. Shell out some, borrow some much more. It is a wonderful way to cope with sudden expenses or prepare for ideal renovations.

Whilst U.S. housing gross sales started to gradual in 2024, it continue to continues to be a seller’s current market, with selling prices high and inventory minimal. So, a preapproval could set you besides competing buyers while you’re bidding on properties.

Other Documentation Throughout the pre-qualification procedure, you may also be necessary to present your driver’s license, Social Stability range, and consent with the lender to perform a credit inquiry. For anyone who is self-used, you might have to provide supplemental income documentation.

This is often why it is best to always make sure about the economical option you make. Luckily, you may get a next feeling from credible pros to again up your selections.

So there’s no commitment about the lender’s part. You'll be able to get a prequalification letter, but it really doesn’t cut A lot ice with sellers.

Our companions don't spend us to feature any specific solution in our information, but we do function some goods and provides from corporations that present payment to LendingTree. This will affect how and where delivers look on the location (like the purchase).

Certainly, some lenders present pre-approvals utilizing option credit rating information including lease payments, utility expenses as well as other non common credit rating sources.

Mortgage preapproval and mortgage prequalification may well typically be utilized interchangeably, but there are important variations among the two.

A mortgage preapproval is prepared verification from a mortgage lender, which states that you qualify to borrow a particular sum of money for a house acquire. The amount you’re authorised for is predicated on an assessment of the credit rating historical past, credit scores, earnings, personal debt and belongings.

After you’ve accomplished the appliance, submit it and every one of the collected documentation. We’ll use this facts To judge your money problem and determine your pre-acceptance position.

Precisely what is mortgage preapproval? Mortgage preapproval vs. prequalification How to get preapproved for a home mortgage Benefits of a obtaining preapproved for a home loan Mortgage preapproval timeline How to proceed When you are preapproved Mortgage preapproval Back again to prime

Reliability with sellers: Your preapproval shows sellers you’re a serious consumer pre-approved mortgage near me who is likely to qualify for financing. It also would make your provide additional compelling.

A bare minimum FICO rating of 620 is commonly necessary for regular loan plus a FHA personal loan requires a minimal Fico score of five hundred. Having said that, be mindful that a hard inquiry with your credit rating report can lessen your rating by a couple of points.

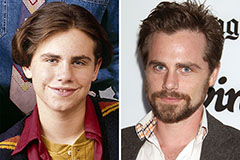

Rider Strong Then & Now!

Rider Strong Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!